Your keys. Your tokens. Always.

Non-custodial wallets

You hold your own assets at all times

Embedded wallets by Privy

Secure key management without seed phrases

Real tokens, not IOUs

Every purchase settles on-chain. You own the actual assets

Full transparency

See every transaction, every allocation, every fee

Frequently asked questions

Crayt is the easiest way to buy a crypto portfolio in one click. Instead of figuring out which chain a token lives on, bridging funds, and making 5–10 separate trades, you just pick a Crayt and buy the whole thing at once. Behind the scenes, Crayt handles the routing across Solana and Base so you don’t have to think about it.

A Crayt is a basket of tokens with fixed percentage allocations. For example, 40% SOL, 30% ETH ecosystem, 20% DeFi, 10% something else. When you buy it, you receive the actual underlying tokens directly in your wallet.

Yes. You own the real tokens in your wallet. Crayt does not custody your assets and does not issue a synthetic index token. You can sell, transfer, or manage your tokens however you want.

You don’t have to manually manage gas or bridge assets yourself. Crayt abstracts that complexity away. Execution costs are bundled transparently into the purchase so you’re not hit with surprise transactions or multiple confirmations.

Crayt currently leverages Solana and Base. That gives access to roughly 90% of the top 300 tokens by market cap, plus thousands more assets across both ecosystems.

Roughly 90% of the top 300 tokens are available through Crayt, along with thousands of additional tokens native to Solana and Base. The goal is broad access without overwhelming complexity.

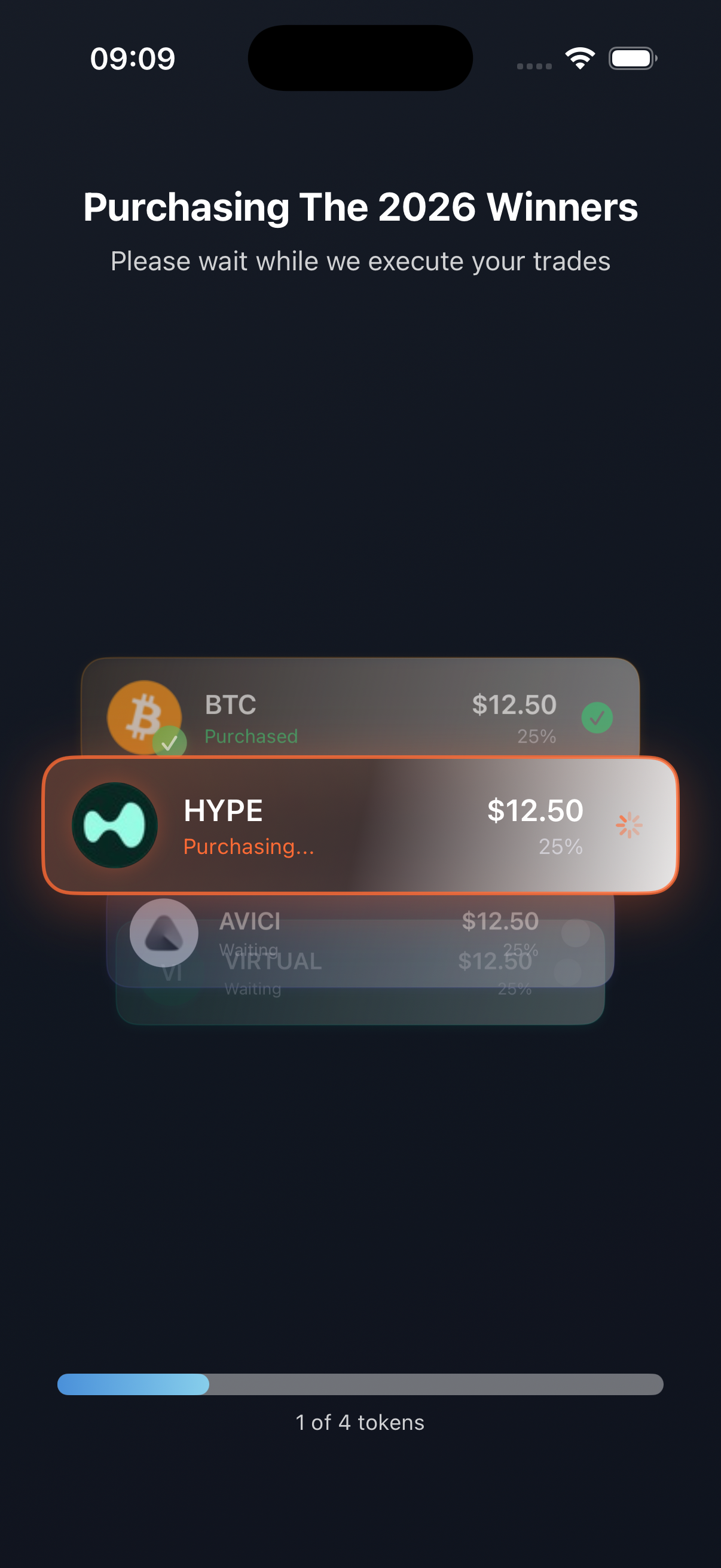

You choose a Crayt, enter how much you want to invest, and confirm a single transaction. Crayt splits the capital according to the allocations and executes everything for you across chains.

Crayt takes a small, transparent platform fee when a Crayt is purchased. There are no hidden management fees and no performance fees. What you see is what you pay.

Yes. When someone buys a creator’s Crayt, the creator earns a share of the platform fee. If you build a Crayt people trust and want exposure to, you can earn every time it’s purchased. It turns portfolio ideas into something you can actually monetize.

No. Crayt is non-custodial. You connect your wallet and the tokens are delivered directly to you.

No. Crayts are portfolio templates created by individuals. They are not managed funds and they are not investment advice. Crypto is volatile. You should always do your own research before buying anything.

You can. But that usually means checking which chain each token is on, bridging assets, managing gas on multiple networks, and placing several trades. Crayt compresses all of that into one action.

Crypto is discussed socially, but investing is still executed individually. Crayt makes it easy to express an idea as a portfolio, share it, compete on performance, and build an audience around your strategy.

Similar idea, different execution. Traditional crypto index funds are managed products with lock-ups and fees. A Crayt is a self-directed basket you own outright — you get the actual tokens, not a share of a fund. Think of it as building your own crypto index fund in seconds, with full control and no middlemen.

Pick a Crayt (or create your own), enter an amount, and confirm one transaction. Crayt splits your capital across every token in the basket and executes all the trades — even across different blockchains — in a single action. No bridging, no chain-hopping, no placing 10 separate orders.

Crayt. Instead of researching which chain each token lives on, setting up multiple wallets, and executing trades one by one, you choose a curated basket and buy the whole portfolio in one swipe. It's the fastest path from zero to diversified.